The New Normal: A Strong Housing Market Expected to Continue into 2021

“2020 will be known for a lot of things, and a record-breaking year for real estate will certainly be one of its more unexpected legacies,” prominent economist Daryl Fairweather said.1 And he’s right: most of us would have expected the housing market to suffer from circumstances like a once-in-a-hundred-years pandemic and historic inventory shortages.

But, rather than a slowdown, we are continuing to experience a surprisingly robust real estate market across the country. And experts estimate that these conditions are likely to last well into the new year. Fannie Mae Senior VP and Chief Economist Doug Duncan predicts that existing home sales will ultimately “be up a percent or more in 2021.” He believes home prices will continue to rise due to limited inventory, but he is confident the Federal Reserve will keep interest rates low into the future, which will be “very good for households.”2

Market conditions like fewer available listings, changing criteria for desired homes, and record-low mortgage rates are changing the way people buy and sell homes, most likely in a lasting way. But this sustained activity, even in the uncertainty that is 2020, proves that our country still views real estate as a sound investment. The only question now is how you can take advantage of the housing market’s “new normal.”

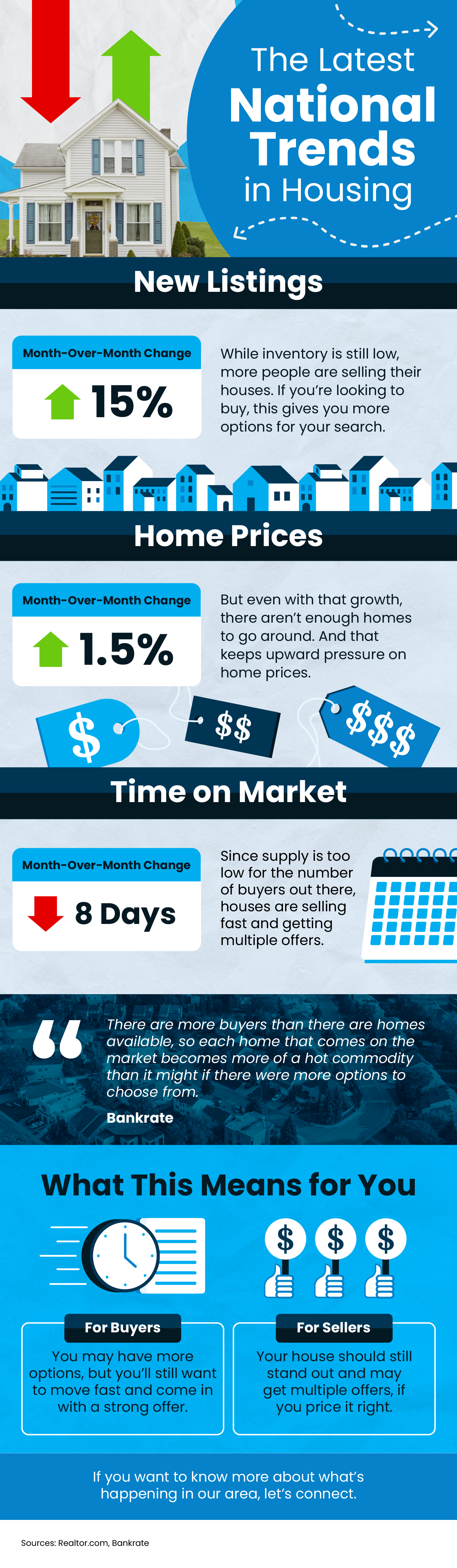

FEWER LISTINGS EQUALS A SELLER’S MARKET

Inventory, meaning the number of homes for sale, is at a record low across the country. The National Association of Realtors (NAR) reports there are fewer homes on the market today than the association has seen in data going all the way back to 1982.3 Currently, the total housing inventory is about 1.47 million units, which is a decline of 19.2% from one year ago.4

Experts do predict some relief on the horizon. MarketWatch had previously anticipated housing starts would occur at a pace of 1.45 million and building permits would come in at a pace of 1.52 million.5 But it turns out that the market exceeded expectations: compared with last year, housing starts are up 11% and permitting for new homes occurred at a seasonally-adjusted annual rate of 1.55 million. That represents a 5% increase from August and an 8% increase from a year ago.

For now, the fact that there are fewer listings creates an advantageous housing market for sellers. There are several reasons why.

For one, buyers have to act fast to snap up available homes. As a result, most properties that come on the market stay for an average of just 21 days before they are sold.6 “That is the fastest ever recorded in our monthly series,” says NAR Chief Economist Lawrence Yun.

Another benefit is that sellers are enjoying higher net returns on their listings. This is thanks to the tough competition for homes, which often results in bidding wars between buyers. Nationwide, the median home price in September rose to $311,800. That translates to about $40,000 (15%) more than just a year ago.7

This seller’s market is not simply a product of the pandemic. In fact, in the country’s top 100 metro markets, inventory has been dwindling since the first quarter of 2020.8 This means that even with increased construction, buyers can’t simply wait for things to go back to normal before reentering the market. Rather, all signs indicate that this is the new normal.

What It Means for Homeowners:

These higher home prices show that buyers are willing to spend more on a home right now than they did last year. So, if there ever were a time to list for top dollar—and expect to receive asking price quickly—that time is now. Ask us for a free consultation of your home’s value today.

What It Means for Homebuyers:

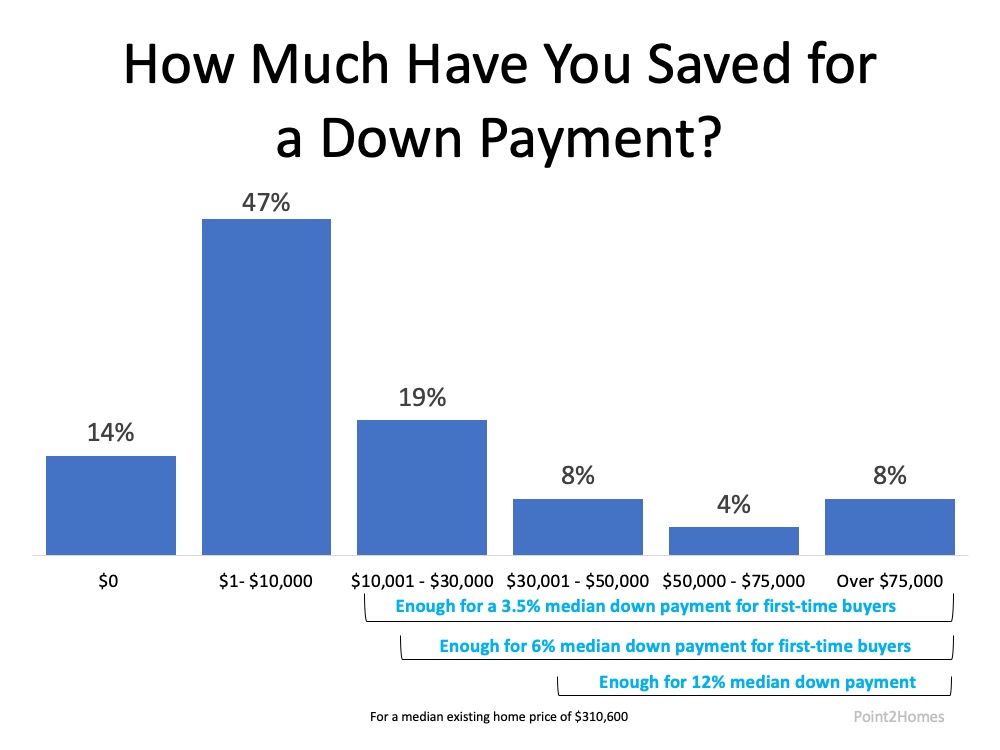

Due to low inventory, buyers could easily find themselves in a bidding war. Time is of the essence in a seller’s market, so you’ll need to get your financing in order and be preapproved for a loan before you begin your home search. We can connect you with a trusted mortgage professional to get you started.

BUYERS BENEFIT FROM LOW MORTGAGE RATES AND A BIGGER PLAYING FIELD

Don’t worry, homebuyers. This “new normal” of real estate has benefits for you too.

For example, people used to base their next home purchase on how far the commute was to work or in which public school district it was. But now, thanks to the pandemic shifting the locus of jobs and work, they are free to consider what they need from a home to make it a place they truly want to be in as they work, teach, exercise, cook, and live.

Often, this equates to needing more space in different types of areas. Realtor.com consumer surveys show that people are desiring quieter neighborhoods, home offices, updated kitchens, and access to the great outdoors.9 The search for these criteria is driving residents out of densely populated metropolitan areas and into the suburbs.10 And this exodus from cities is good news for buyers: it opens up more possibilities for inventory that they could not have considered pre-pandemic.

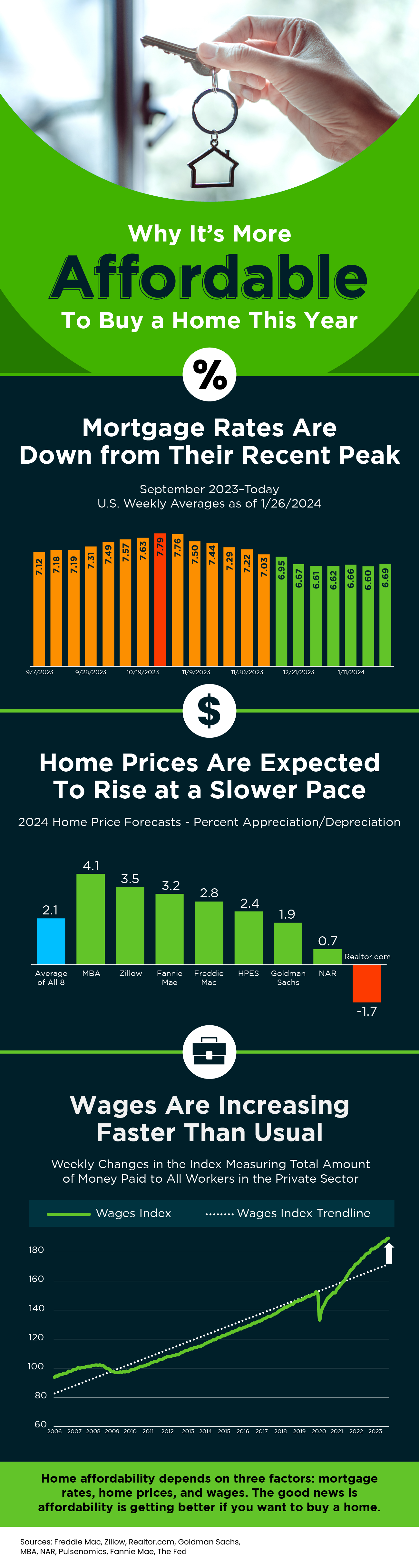

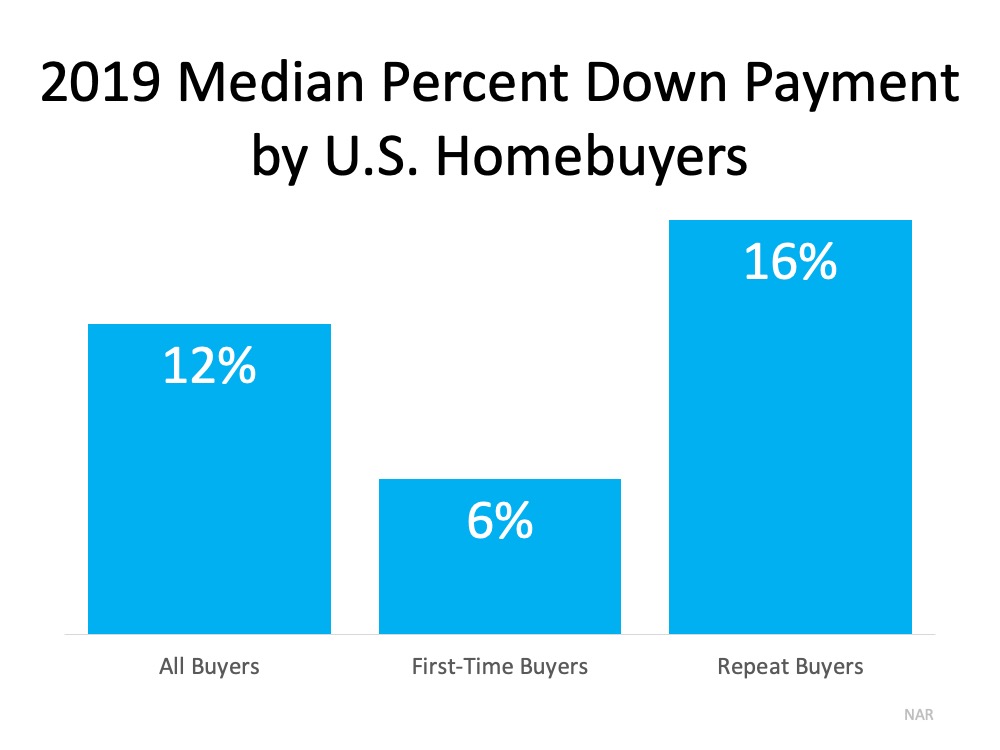

Another advantage for buyers is the record-low mortgage rates. The average rate for a 30-year fixed-rate mortgage hit a record low in mid-October when rates fell to 2.81%. That’s the lowest since Freddie Mac began conducting the survey in 1971, and well below last year’s 3.69%.11 Similarly, a 15-year fixed-rate mortgage can be had for as low as 2.35% compared to 3.15% a year ago.

Thanks to these rates, buyers are afforded the opportunity to buy nearly $32,000 more home than they could one year ago, while keeping their monthly payment the same.12 So even though home prices are high now, it is currently more affordable to buy a home now than it was last year.

If you want to take advantage of these rock-bottom mortgage rates, you need to act fast. Though rates are projected to stay low, housing economists predict that the window of opportunity to get the best rate could be closing in the coming months. Mike Fratantoni, chief economist at the Mortgage Bankers Association, said he expects the average rate on a 30-year mortgage to rise to 3.5% by the end of 2021.13

What It Means for Homeowners:

Record-low mortgage rates offer you the opportunity to lower your monthly payment—or even take out some equity—with a refinance. With those additional funds, you could even choose to invest in a second home in a new desirable location. Reach out to us for a referral to a trusted mortgage professional or an agent in those markets.

What It Means for Homebuyers:

The time is now to determine how much home you can comfortably afford and make a plan to find it. We can set up a search for you to find homes that best meet your new needs, even if they’re in neighborhoods you wouldn’t have considered before.

A RECORD-SETTING YEAR FOR HOME SALES IS JUST THE BEGINNING

Despite the seemingly adverse buyer conditions, 2020 experienced a 14-year high number of home sales, NAR reports. Existing-home sales, which include single-family homes, townhomes, condominiums and co-ops, rose 9.4% in September to a seasonally adjusted annual rate of 6.54 million.14 That’s a 21% increase from a year ago!

Every region of the country has seen a surge in sales activity. According to George Ratiu, senior economist for Realtor.com, part of the reason for these continued sales is that the pandemic has created a paradigm shift in the patterns of real estate.15 For example, housing needs are typically resolved by late summer and early fall to coincide with the commencement of the new school year. With homeschooling and remote work, however, buyers have been freed to continue their home search into the traditionally slow winter months.

Another reason for the robust market is that Millennials are finally putting their money into homeownership. According to the U.S. Census Bureau, the homeownership rate for 25-to-34-year-olds rose to 40.7% by the end of last year.16 This is significant because Millennials, the generation of people in their mid-20s to late-30s, currently surpasses Baby Boomers as the nation’s largest living adult generation. As the remaining percentage of this group starts investing in homes in the near future, demand will persist.

All of these factors indicate that the housing market is poised to remain strong as we head into the new year. And as Jonathan Woloshin, head of U.S. real estate at UBS Global Wealth Management, believes, they could “buoy the housing market for years to come.”17

What It Means for Homeowners:

It’s tempting to believe that homes will basically sell themselves in a market like this. But we’re still seeing properties that are overpriced and under-marketed sit unsold. We can help you optimize the process of selling your home so you can get the best possible offer.

What It Means for Homebuyers:

Preparation is key to success in a seller’s market like this, but don’t let yourself become paralyzed. We are here to answer your questions and offer sound advice to guide you through all the options that are available to you.

REAL ESTATE IS A SAFE BET

Your other investments might have been on roller coasters this year, but the real estate market has been steady, competitive, and strong throughout. That makes it a good choice for your financial future.

National real estate numbers can give us a pulse on the market, but real estate happens in our own backyard. As your local market experts, we can help you understand the finer points of the market that impact sales and home values in your own neighborhood.

If you’re considering buying or selling a home before the new year or in early 2021, contact me now to schedule consultation. I will work closely with you to develop an actionable plan to meet your goals.

Sources:

- Redfin –

https://www.redfin.com/news/housing-market-news-september-2020/

- Housing Wire –

https://www.housingwire.com/articles/fannie-maes-doug-duncan-offers-his-predictions-for-2021/

- CNBC –

https://www.cnbc.com/2020/10/22/september-existing-home-sales-jump-9point5percent.html

- NAHB –

http://eyeonhousing.org/2020/10/existing-home-sales-surge-despite-record-low-supply

- MarketWatch –

https://www.marketwatch.com/story/new-home-construction-slows-slightly-in-august-driven-by-pullback-in-multifamily-starts-2020-09-17

- National Association of Realtors –

https://www.nar.realtor/newsroom/existing-home-sales-soar-9-4-to-6-5-million-in-september

- Business Insider – https://www.businessinsider.com/how-2020-broke-the-housing-market-inventory-could-run-out-2020-9

- Forbes –

https://www.forbes.com/sites/petertaylor/2020/10/11/covid-19-has-changed-the-housing-market-forever-heres-where-americans-are-moving-and-why/#74e7355761fe

- Realtor.com –

https://www.realtor.com/research/top-consumer-home-features-coronavirus/

- Wealth Advisor – https://www.thewealthadvisor.com/article/covid-19-has-changed-housing-market-forever-heres-where-americans-are-moving-and-why

- Washington Post –

https://www.washingtonpost.com/business/2020/10/15/30-year-mortgage-rate-drops-record-low/

- Forbes –

https://www.forbes.com/advisor/mortgages/buying-a-home-low-mortgage-rates/

- BankRate –

https://www.bankrate.com/mortgages/refinance-window-could-close-soon/

- National Association of Realtors –

https://www.nar.realtor/newsroom/existing-home-sales-soar-9-4-to-6-5-million-in-september

- Forbes –

https://www.forbes.com/sites/petertaylor/2020/10/11/covid-19-has-changed-the-housing-market-forever-heres-where-americans-are-moving-and-why/#74e7355761fe

- TD Economics –

https://economics.td.com/us-falling-mortgage#:~:text=The%20homeownership%20rate%20among%20millennials,47.7%25%20at%20a%20comparable%20age.&text=This%20means%20that%201.4%20million,that%20of%20the%20older%20generation

- Axios Media –

https://www.axios.com/real-estate-market-819e3c85-3765-4014-91c0-b545be6d5935.html

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link